HUD-27061-H 2003-2026 free printable template

Show details

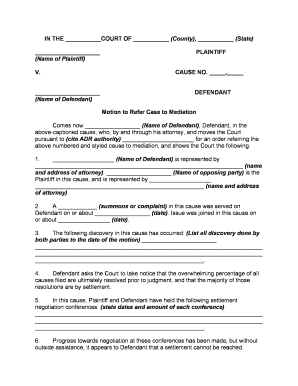

Race and Ethnic Data Reporting Form U.S. Department of Housing and Urban Development Office of Housing OMB Approval No. 2502-0204 (Exp. 03/31/2014) Name of Property Project No. Address of Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hud race and ethnicity form

Edit your race and ethnic data reporting form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hud form 27061 h form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit race and ethnicity hud form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hud race and ethnicity form 27061 h

How to fill out HUD-27061-H

01

Obtain a copy of HUD-27061-H from the HUD website or your local housing authority.

02

Start by filling out the 'Applicant Information' section, providing your name, address, and contact details.

03

In the 'Program Information' section, enter the program you are applying for.

04

Fill in the 'Race and Ethnicity' section, ensuring to select the appropriate categories that apply to you.

05

Complete the 'Income' section, providing details on your total household income.

06

Review all the information for accuracy before submitting.

07

Submit the form along with your application to ensure it is processed.

Who needs HUD-27061-H?

01

Individuals applying for HUD housing programs such as Section 8 or public housing.

02

Housing authorities and organizations that require demographic data for compliance with fair housing laws.

03

Social service organizations assisting clients in securing housing resources.

Fill

form hud 27061 h

: Try Risk Free

People Also Ask about hud 27061

What is a HUD 27061 form?

This form is used by applicants and in-place tenants of Multifamily Housing programs to provide self-certification of race and ethnicity for data collection purposes.

What is a sample of race and ethnicity?

For example, people might identify their race as Aboriginal, African American or Black, Asian, European American or White, Native American, Native Hawaiian or Pacific Islander, Māori, or some other race. Ethnicity refers to shared cultural characteristics such as language, ancestry, practices, and beliefs.

What are the options for race and ethnicity?

OMB requires five minimum categories: White, Black or African American, American Indian or Alaska Native, Asian, and Native Hawaiian or Other Pacific Islander.

What is the race and ethnic data reporting form?

HUD Form 27061-H Race and Ethnic Data Reporting Form– used to collect information from individual applicants; and. HUD Form 27061 Race and Ethnic Data Reporting Form– Used to consolidate collected information for a property.

Is HUD-92006 required?

Although it is not required, O/As and PHAs should provide tenants who were not provided the opportunity to provide contact information at the time of application and admission, the option to complete form HUD-92006 and provide contact information at the time of their next annual reexamination/recertification.

What is HUD 9886 form?

HUD 9886- Authorization for Release. Form along with the HUD Authorization for the Release of Information must be signed by all adult family members. Form is provided to the family at the time of annual re-examination, briefing session, or when family is adding a family member.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find race and ethnicity form hud?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form 50075 2 fillable in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit hud 52517 blank in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your what is the purpose of promote equal opportunity in housing, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the HUD-27061-H form on my smartphone?

Use the pdfFiller mobile app to fill out and sign HUD-27061-H on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is HUD-27061-H?

HUD-27061-H is a Housing and Urban Development form used for reporting information related to fair housing and equal opportunity in housing programs.

Who is required to file HUD-27061-H?

Organizations participating in HUD-funded programs, specifically those that deal with housing and community development, are required to file HUD-27061-H.

How to fill out HUD-27061-H?

To fill out HUD-27061-H, obtain the form from the HUD website or local HUD offices, provide accurate demographic information as requested, and ensure all relevant sections are completed before submission.

What is the purpose of HUD-27061-H?

The purpose of HUD-27061-H is to collect data to ensure compliance with fair housing laws and to promote equal opportunity in housing.

What information must be reported on HUD-27061-H?

HUD-27061-H requires reporting demographic information such as race, ethnicity, and gender of applicants for housing assistance.

Fill out your HUD-27061-H online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HUD-27061-H is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.